2

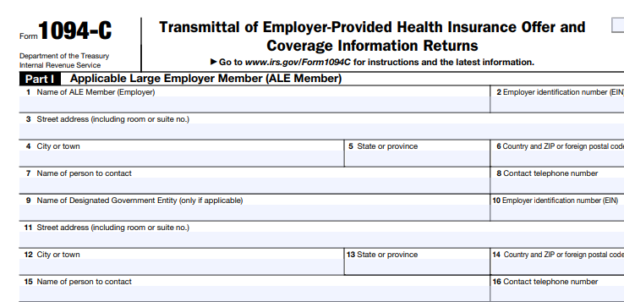

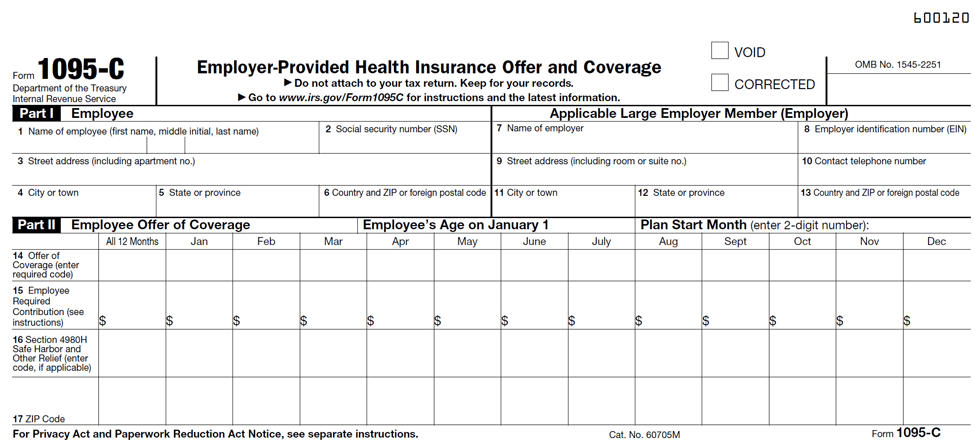

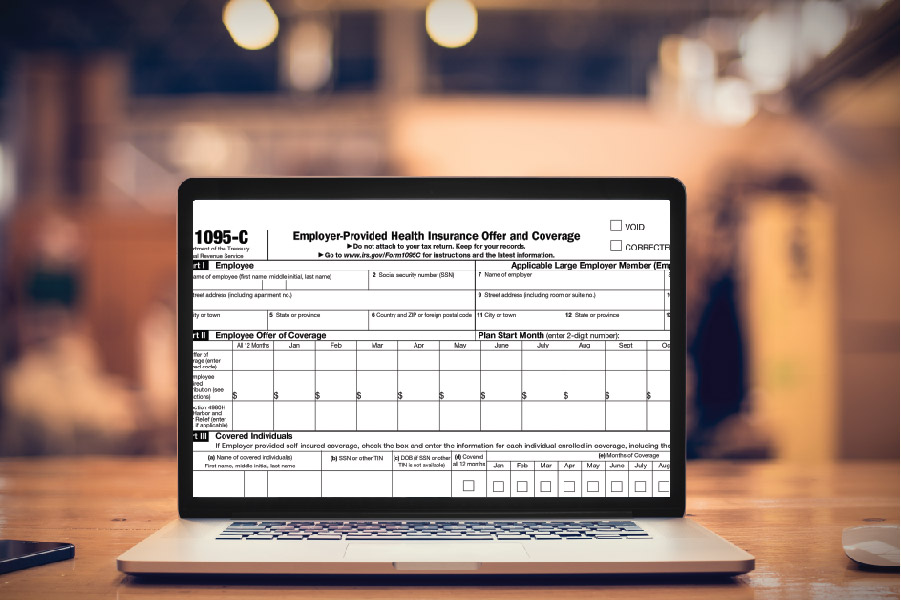

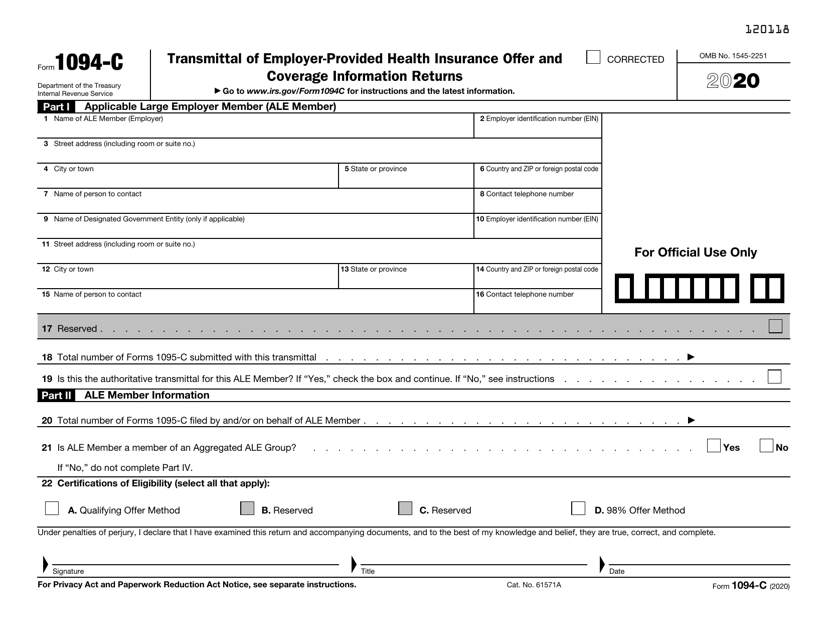

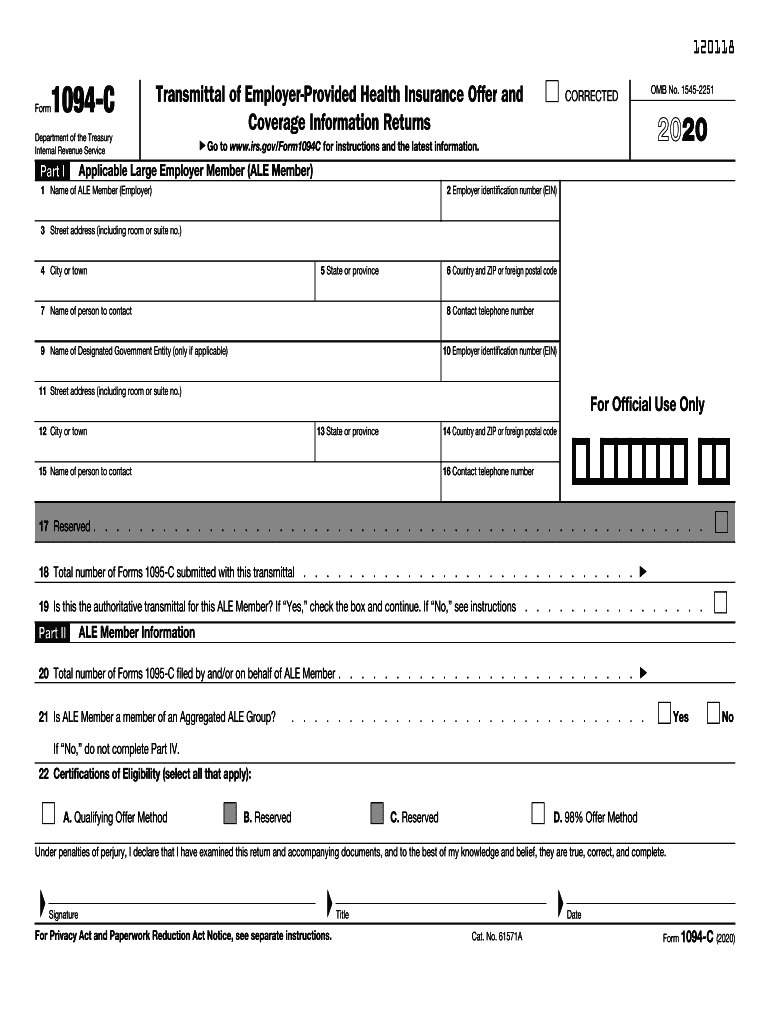

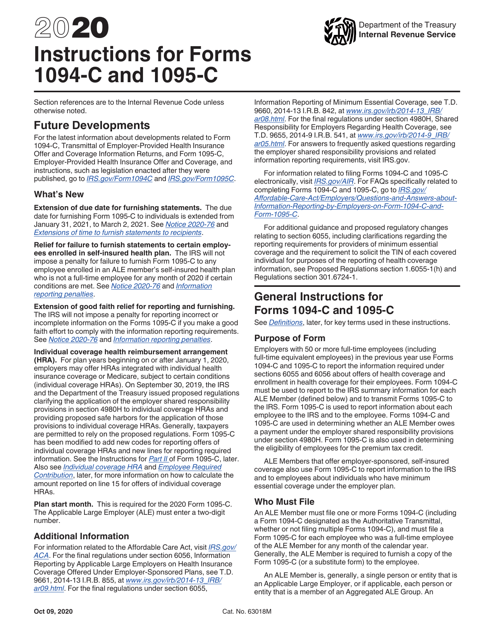

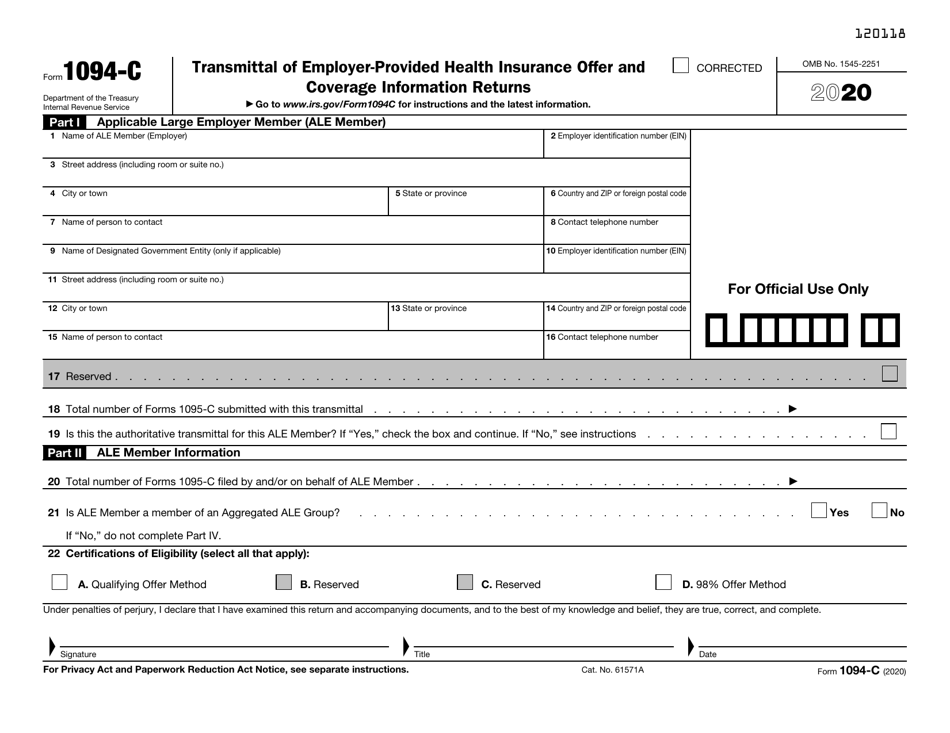

Step 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only The IRS has released the 18 Forms 1094C, 1095C and form instructions There are no significant changes to the forms or instructions, however there are a few minor formatting changes on Form 1095C

1094 c instructions 2018

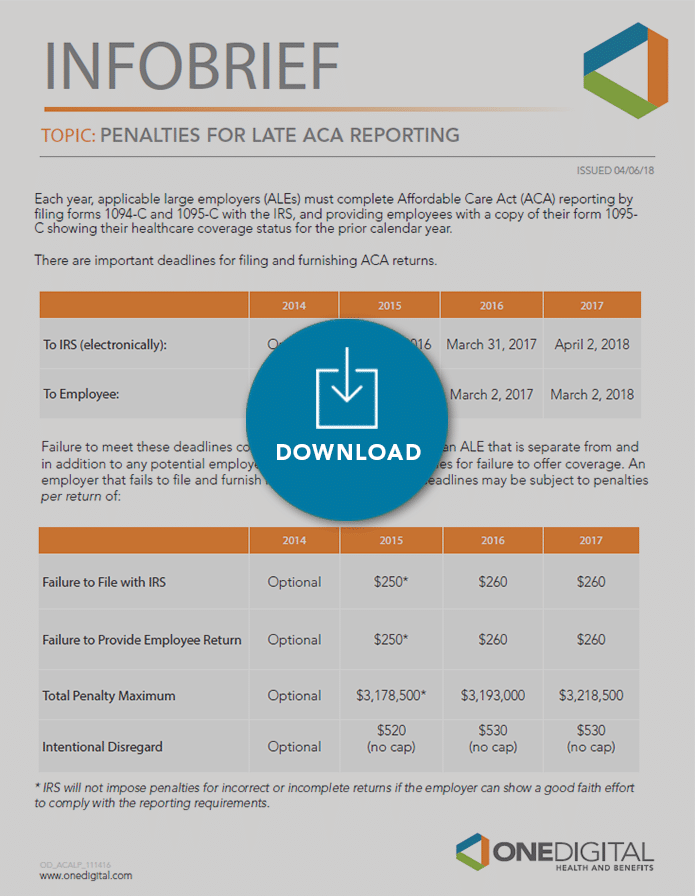

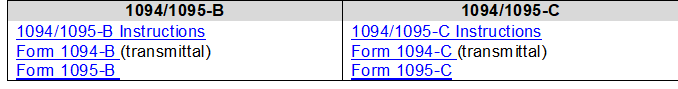

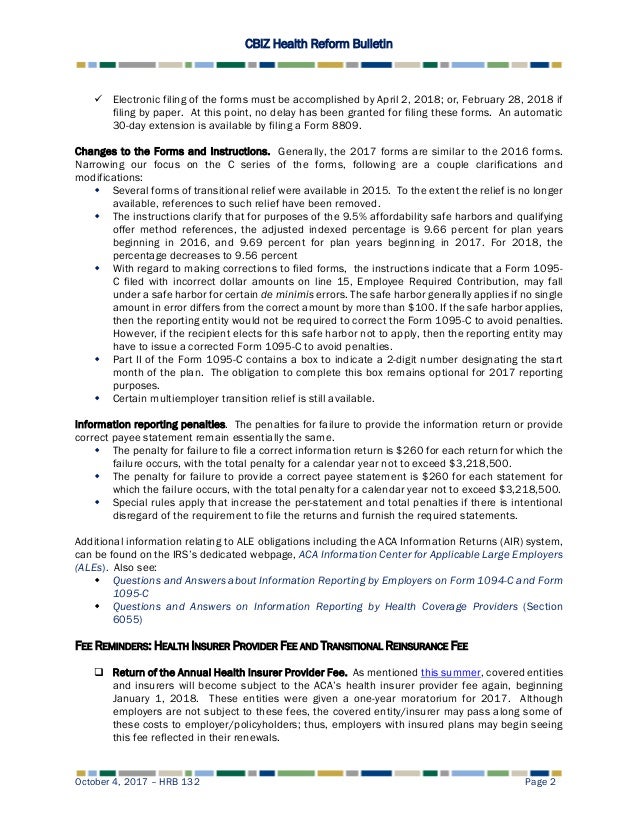

1094 c instructions 2018-• Review Forms 1094C and 1095C • After your review of Letter 226J you may disagree in whole or in part with the IRS assessment Inaccurate reporting on Forms 1094C and 1095C are most likely the cause of incorrect penalty assessments The Forms 1094C and 1095C are the forms the IRS uses to calculate ESRP assessmentsSimilar to the 1094C and 1095C corrections, the 16 Instructions for Forms 1094B and 1095B contain discussions on correction methods and Section 71 of Publication 5165 is the source for instructions for making a correction to a Form 1095B filed electronically

1

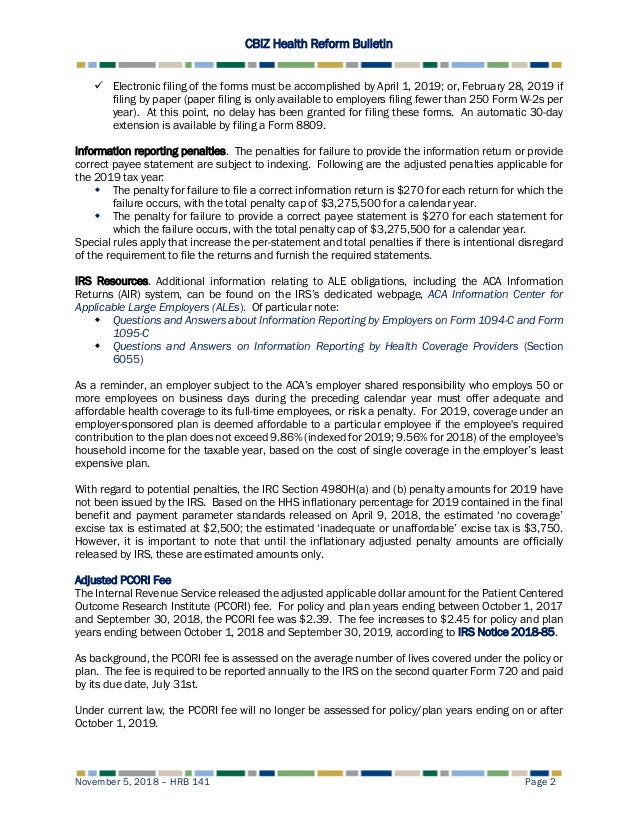

A business day is any day that is not a Saturday, Sunday, or legal holidayGenerally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates Final Instructions for the Forms 1094C and 1095C Released with Few Changes – However IRS Enforcing the Employer Mandate Changes Everything The IRS recently released the final instructions to the Forms 1094C and 1095C with minimal changes compared to the final instructions from 17 Most of the changes made compared to previous The IRS released draft instructions for both the 1094B and 1095B forms and the 1094C and 1095C forms and the draft forms for 1094B, 1095B, 1094C, and 1095C There are no substantive changes in the forms or instructions between 18 and 19

October 18 The Internal Revenue Service ("IRS") has released the final 18 version of the Affordable are Act ("AA") Information Reporting forms, aka Forms 1094 and 1095 and instructions Applicable Large Employers ("ALEs")¹ are obligated to issue and file the 18 AA information returns Other than some formatting On Sept 11, 18, the IRS released a draft version of the instructions for Forms 1094C and 1095C, which are used by large employers to comply with Section 6056 reporting under the PPACA The instructions are largely unchanged from the 17 versions The Plan Start Month in Part II of the Form 1095C continues to be an optional fieldInstructions to Forms 1094C and 1095C;

1094 c instructions 2018のギャラリー

各画像をクリックすると、ダウンロードまたは拡大表示できます

|  |  |

|  | |

| ||

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

| ||

|  | |

|  | |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  |  |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

| ||

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  | |

|  | |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  | |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  | |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  |  |

|  | |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  | |

|  | |

|  |  |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |  |

|  |  |

「1094 c instructions 2018」の画像ギャラリー、詳細は各画像をクリックしてください。

|  |  |

|  |

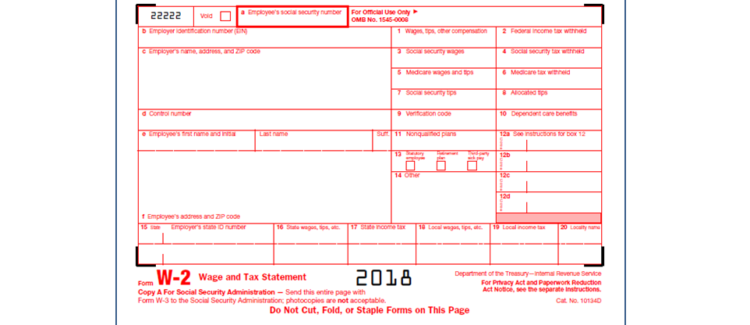

Applicable large employers (ALEs) that submitted Forms 1094C and 1095C should correct any errors as soon as possible to avoid possible penalties All ALEs are required to use these forms to report information about group health coverage, regardless of whether they "play or pay" in accordance with the Affordable Care Act's Employer Shared Responsibility provisions All applicable large employers (ALE) must file Forms 1094C and 1095C with the IRS and furnish a copy of the 1095C to all fulltime employees The insurance carrier for a fully insured plan must complete Forms 1094B and 1095B Generally, only employers that are nonALEs with a selfinsured plan will complete Forms 1094B and 1095B

Incoming Term: 1094 c instructions 2018, 1094 c instructions 2019, form 1094 c 2018 instructions,

0 件のコメント:

コメントを投稿